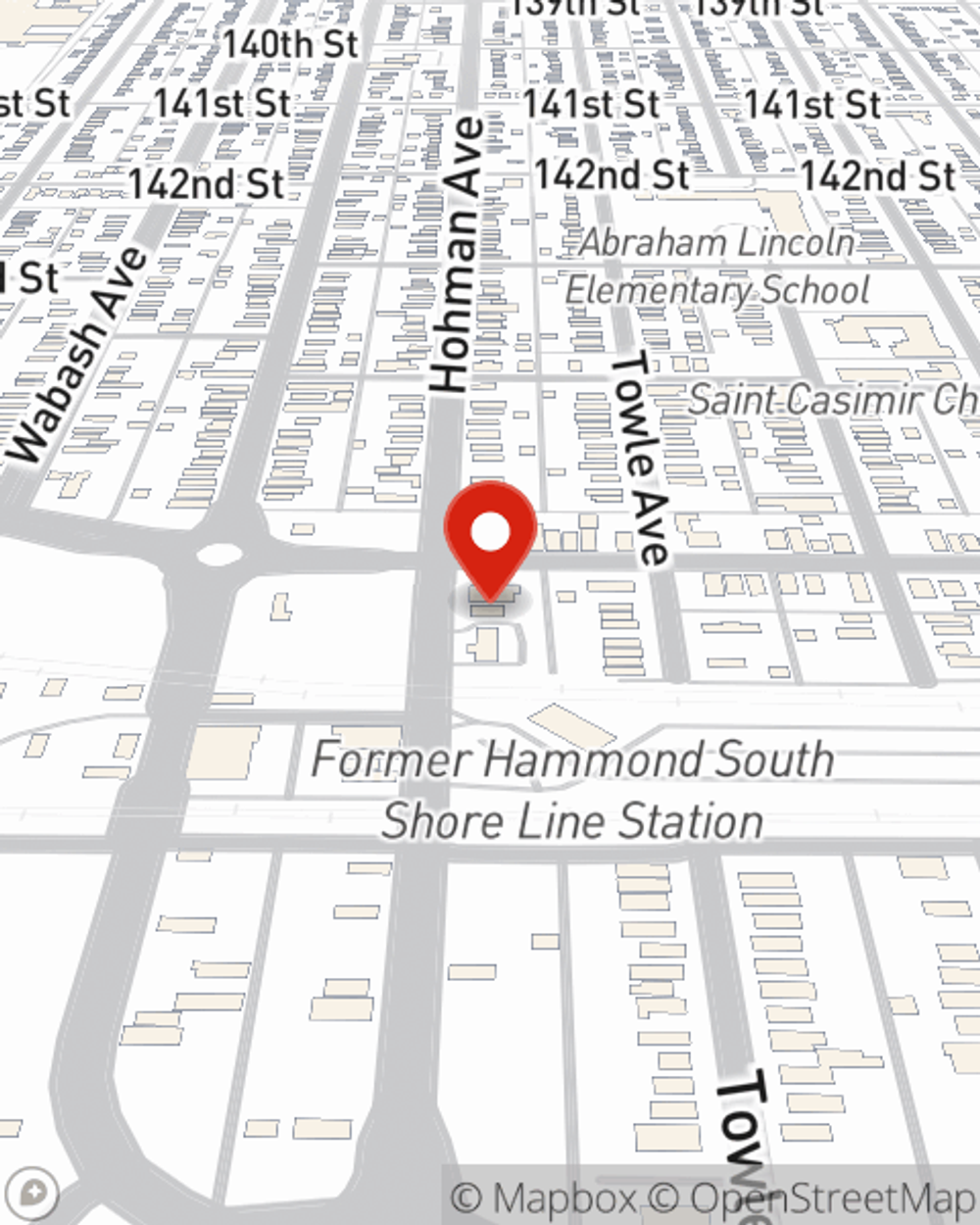

Business Insurance in and around Hammond

Searching for protection for your business? Look no further than State Farm agent Edwin De Jesus!

Cover all the bases for your small business

- Hammond

- East Chicago

- Whiting

- Munster

- Highland

- Gary

- Dyer

- Griffith

- Schererville

- Merrillville

- Calumet City

- Hegewisch

- Chicago

- Portage

- Lake Station

- Crown Point

- Valparaiso

- Lansing

- Homewood

- Lowell

- St. John

- Hobart

- Blue Island

- Winfield

Insure The Business You've Built.

Do you own an ice cream shop, a clock shop or an art school? You're in the right place! Finding the right protection for you shouldn't be risky business so you can focus on what matters most.

Searching for protection for your business? Look no further than State Farm agent Edwin De Jesus!

Cover all the bases for your small business

Customizable Coverage For Your Business

You are dedicated to your small business like State Farm is dedicated to great insurance. That's why it only makes sense to check out their coverage offerings for surety and fidelity bonds, commercial liability umbrella policies or commercial auto.

Let's review your business! Call Edwin De Jesus today to learn why State Farm has been rated one of the top overall choices for insurance coverage by small businesses like yours.

Simple Insights®

How to collect rent from tenants

How to collect rent from tenants

There are many ways to collect rent from your tenants. It's important to consider the one that best suits your needs.

Checklist for apartment renting

Checklist for apartment renting

When finding an apartment, it’s important to know what to look for so you can make a smart assessment about each property you’re interested in.

Edwin De Jesus

State Farm® Insurance AgentSimple Insights®

How to collect rent from tenants

How to collect rent from tenants

There are many ways to collect rent from your tenants. It's important to consider the one that best suits your needs.

Checklist for apartment renting

Checklist for apartment renting

When finding an apartment, it’s important to know what to look for so you can make a smart assessment about each property you’re interested in.